5 Tech Company Investment Stages

Manoj

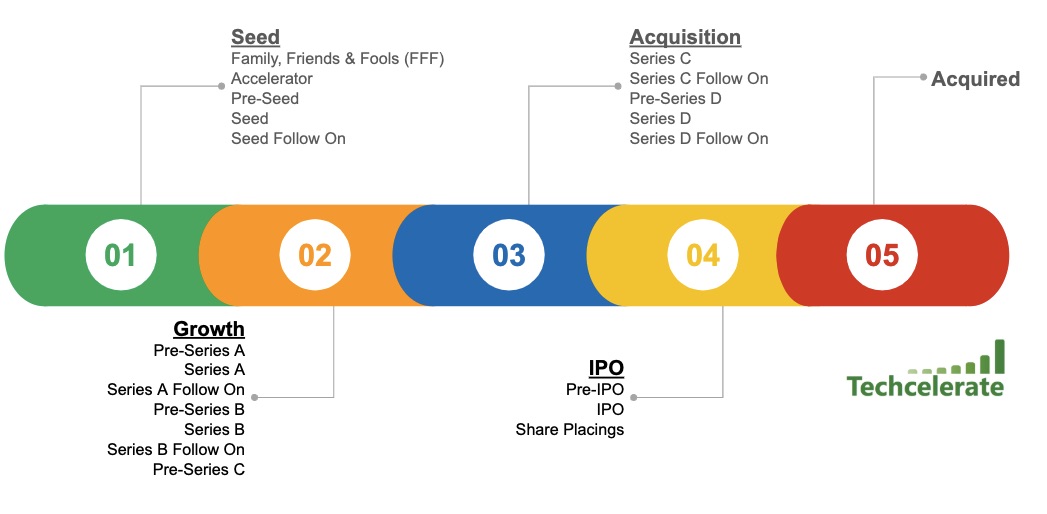

Having classified the investment rounds last month for our own sanity, I have been thinking further about the key investment stages of a tech product company from inception to its eventual exit. I believe there are four key stages with the fifth being acquired, which of course does not result in raising investment:

- Seed – From inception to reaching product/market fit.

- Growth – Scaling once the product/market fit is achieved.

- Acquisition – It’s hard to acquire significant market share without acquisitions.

- IPO – Most founders dream of ringing the bell. Finally, an opportunity to provide liquidity to your long-suffering shareholders.

- Acquisition – Time to hit the beach and enjoy the rest of your life, i.e. setup your own venture capital firm with your mates.

[su_button url=”http://eepurl.com/dynmsn” target=”blank” style=”flat” size=”14″]Subscribe to Deal News[/su_button]

Delivered to your inbox every Monday (past Editions)

Of course, not every tech product company goes through these investment stages. You could get acquired even just after your FFF. Equally, you could even go belly up just before an IPO, as illustrated in yesterday’s article by Alexandra Morris when you raise investment for the wrong reasons.

[su_divider top=”no”]

Article by Manoj Ranaweera – Founder of Techcelerate

Article by Manoj Ranaweera – Founder of Techcelerate

1st tech startup Manoj founded in 2004 failed in 2006 costing him more than his shirt. He bootstrapped edocr.com all the way to its exit to Accusoft. Manoj built and exited Northern Tech Awards to GP Bullhound. Techcelerate is Manoj’s 11th venture where he uses his know-how and network to help technology companies succeed.