MRR expectations for investment rounds

Manoj

Revenue Targets

The Monthly Recurring Revenue (MRR) benchmarks for funding rounds continue to rise, where demand for equity finance is high.

| Techcelerate | ChatGPT | Claude | Gemini | Grok | |

| Pre-Seed | £0 – £10k | £0 – £40k | £0 – £8k | £0 – £5k | £0 – £15k |

| Seed | £10k – £100k | £40k – £160k | £8k – £32k | £5k – £100k | £15k – £50k |

| Series A | £100k – £200k | £80k – £400k | £133k – £667k | £100k – £500k | £50k – £125k |

| Series B | £200k – £1m | £400k – £800k | £800k – £2m | £800k – £3m | £125k – £147k |

You need to take Gen AI responses with a pinch of salt as they summarise based on Internet searches instead of analysing investment round data from proprietary services such as Pitchbook, Deal Lite, etc.

Many companies bootstrap during the early years as a result of the current funding drought, resulting in higher revenues when raising funding.

What used to be Pre-Seed has been Seed for a number of years now. The same goes for all other rounds. The benchmarks keep rising.

Key Stages

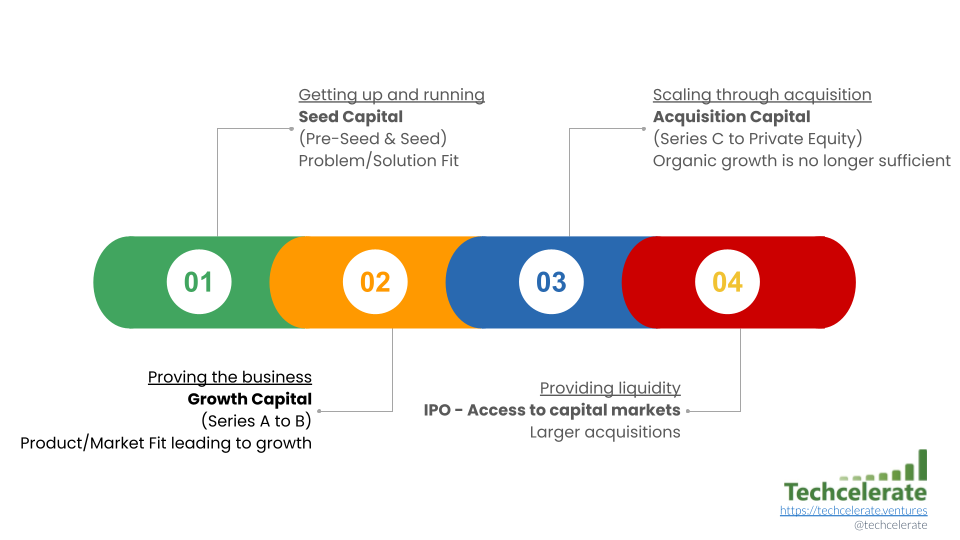

Tech startups go through many stages in their lifetime. If we summarise it to four stages, these would be:

- Stage 1 – Getting up and running.

- Stage 2 – Proving the business.

- Stage 3 – Scaling through acquisitions.

- Stage 4 – Providing liquidity for shareholders and leveraging retail investors.

Techcelerate is your trusted partner in the tech founder’s Start to Exit journey, which could happen any time. Not always does Founder Exit align with the Company’s Exit.

Partner Services

We need more Partners to join Techcelerate to deliver a comprehensive array of services aligned to each of the key stages.

- Accounting & finance

- Legals – Aaron & Partners

- Product development

- Recruitment

- Sales

- Marketing

- Fundraising

- M&A

Aligning to Key Stages

As an example, let’s take accountancy and finance services:

| Financial Accounting | Management Accounting | Corporate Finance | |

| Stage 1 | – Setting up bookkeeping system – Preparing P&L, Balance Sheet and Cashflow Statements – Ensuring compliance – Tax registration and basic tax filings | – Budgeting for startup costs – Cost tracking for initial operations – Break-even analysis – Cash flow forecasting – Setting up internal financial reporting | – Securing seed funding or angel investment – Developing financial projections for investors – Valuation for equity allocation – Managing capital structure (debt vs. equity) – Cash flow management for runway |

| Stage 2 | – Preparing audited financial statements – Implementing revenue recognition policies – Managing accounts receivable/payable – Tax planning and compliance (e.g., R&D tax credits) – Financial reporting for stakeholders | – Variance analysis (budget vs. actual) – Product or service profitability analysis – Key performance indicator (KPI) tracking – Cost-volume-profit (CVP) analysis – Forecasting for growth initiatives | – Raising venture capital or Series A funding – Financial modeling for scalability – Assessing cost of capital – Structuring debt financing – Evaluating ROI on growth projects |

| Stage 3 | – Consolidation of financial statements – Purchase price allocation (PPA) for acquisitions – Goodwill and intangible asset accounting – Ensuring compliance with acquisition-related regulations – Tax structuring for acquisitions | – Due diligence cost analysis – Synergy analysis for acquisitions – Budgeting for integration costs – Performance tracking of acquired entities – Resource allocation for scaling operations | – Valuation of target companies – Structuring acquisition financing (debt/equity) – Managing capital structure post-acquisition – Cash flow analysis for acquisition funding – Risk assessment for M&A deals |

| Stage 4 | – Compliant financials for public markets – Regulatory filings – Implementing internal controls – Managing auditor relationships – Financial disclosures for investors | – Forecasting for public market expectations – Cost management for IPO process – KPI reporting for investor relations – Budgeting for public company operations – Scenario analysis for market fluctuations | – Valuation for IPO pricing – Structuring equity offerings – Managing underwriting agreements – Capital structure optimization – Investor roadshow financial strategy |

Delivery Methods

In the next 4 months, we plan to run:

- Techcelerate Coffees in Manchester, Daresbury and Liverpool

- Workshops

Key Differentiator

Planning to create accountability sessions, which started with Founders Club and Startup for Slaughters during Techcelerate’s 2006 to 2013 era. Whilst not planning to repeat the same, the new accountability service is currently being developed.