Classifying investment rounds

Manoj

There are so many words used to describe investment rounds and it’s just getting crazy, especially if you are trying to understand the venture capital investment market for the first time.

Given that we have now released 26 weekly editions of Techcelerate Investment Deal News of UK technology companies, it makes sense to rationalise the words we use when describing the fundraising a technology company has completed.

Stages

I’m sure this is not going to please everyone, but I need to bring some sanity to our own reporting.

Here goes:

- Pre-Seed – this is your SEIS round either through Family, Friends and Fools (FFFs) and/or Angel Investors. This may fund the development of the so-called Minimum Viable Product (MVP). Given that it does not cost much to build an MVP, you should really be further on with your journey before giving away any equity.

- Seed – You have some level of traction, even if that has not resulted in generating revenues. The more traction you have, the less equity you have to give away. You ought to have reached [su_highlight background=”#fbff99″]Problem/Solution Fit[/su_highlight] at this stage as a minimum, i.e. you need to demonstrate a deeper understanding of the problem you are solving.

- Seed Follow On, Seed+ or Pre-Series A – you have not achieved sufficient traction to convince Series A investors, why they should invest in your world-beating technology company.

- Series A – You have reached [su_highlight background=”#fbff99″]Product/Market Fit[/su_highlight] with growing revenues. Metrics are strong to justify a deep understanding of Customer Acquisition Cost (CAC) and Customer Life Time Value (CLTV). You have an understanding of what it would take to grow the business. Strategy and positioning become even more important at this stage.

- Series A Follow-On, Series A+ or Pre-Series B – You need a top up to keep growing the business until the metrics are strong enough to get the attention of the big boys!

- Series B

- Series B Follow-On, Series B+ or Pre-Series C

- Series C

- …….

- Pre-IPO

- IPO

- Share Placing

Pre Series X happens when you do not have sufficient metrics to attract new and bigger investors. Same goes for Post Series X, as the round may not be sufficiently high to attract bigger and more strategic investors.

What determines a round is not how much money one has raised, it’s in fact what the stage the company is in. Stage in many cases is proportional to the level of traction a company has achieved, usually measured in some form of revenue growth.

[su_button url=”http://eepurl.com/dynmsn” target=”blank” style=”flat” size=”14″]Subscribe to Deal News[/su_button]

Delivered to your inbox every Monday (past Editions)

Crowdfunding

Ironically, Crowdfunding can be raised at any time, whether as a round of its own or as a top up, as demonstrated by consumer tech companies, especially in financial and banking services, e.g. Monzo.

Dilution

On the flip side, every time you raise investment, you are giving away ownership of the company to strangers, who may help you to grow the company, or may not.

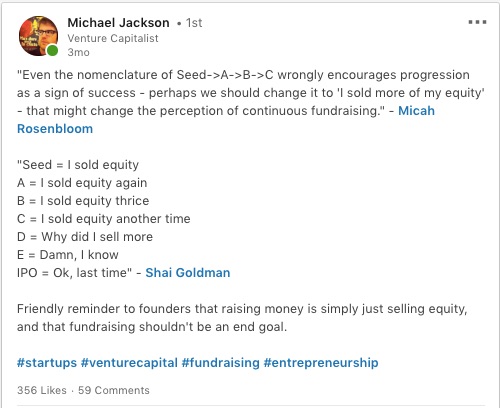

A few months back, Michael Jackson, a venture capitalist highlighted the issue and the dangers associated with continually fund raising.

Unfortunately with tech companies, there are so many dynamics at play, which means what works for one company would rarely work for another. All I can suggest is that be sensible when fundraising and make sure you do not dilute your shareholding prematurely.

Downrounds

Whatever you do, you need to avoid getting into a situation where your next round is raised at a lower valuation than the previous round. Those who raise a Seed round at a very high valuation might find it difficult to raise Series A at a higher valuation if value created was lower than planned. Take a sensible approach to when valuing your company.

Image Credits: Startup.co

[su_divider top=”no”]

Article by Manoj Ranaweera – Founder of Techcelerate

Article by Manoj Ranaweera – Founder of Techcelerate

1st tech startup Manoj founded in 2004 failed in 2006 costing him more than his shirt. He bootstrapped edocr.com all the way to its exit to Accusoft. Manoj built and exited Northern Tech Awards to GP Bullhound. Techcelerate is Manoj’s 11th venture where he uses his know-how and network to help technology companies succeed.