Where does Manchester fit into UK and European funding markets?

Manoj

[su_button url=”http://eepurl.com/dynmsn” target=”blank” style=”flat” size=”12″]Subscribe to Deal News[/su_button]

According to research undertaken by London & Partners, UK captured more funding than any other European country since Brexit vote with London attracting 80% of that funding and topping other European cities with ease.

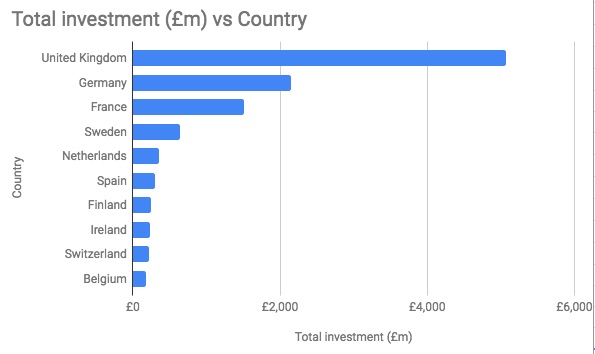

Based on data taken from PitchBook from 24th June 2016 to end of May 2018, the following graph captures the level of investment in each of the major European countries.

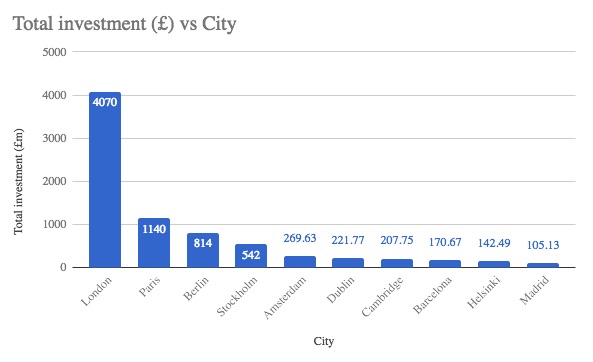

£3.5 billion of the £5.07 billion UK funding originated from the United States (US). UK remains the largest hub for US investment into Europe. For the same period, the following graph captures the level of investment in each of the major European cities. Clearly, 80% of UK investment has gone into London.

For the same period, the following table shows the top sectors which attracted venture capital in five of the major cities.

| Fintech | Artificial Intelligence | Ecommerce | Cybersecurity | |

| London | £1.79bn | £405.09m | £1.21bn | £168.37m |

| Paris | £228.28m | £204.77m | £252.37m | £79.53m |

| Berlin | £358.36 | £33.49m | £1.045bn | – |

| Stockholm | £395.15m | £52.85m | £41.78m | £21.04m |

| Dublin | £68.56m | £13.82m | £6.27m | £1.15m |

Among the top Fintech companies which drew investment into London are Transferwise (£211m), Revolut (£177m Series C creating a new unicorn), Monzo (£71m) and eToro (£71m). Both Transferwise and Revolut were setup by Europeans and now registered in London, the irony of Brexit. This is not by accident as London led the Fintech revolution from the beginning by setting up the first Fintech hub at Level 39. With Banks opening up access through PSD2 and other initiatives, Fintech sector will continue to attract further investment.

London AI companies attracting major investment include Starship Technologies (£13m) and Realeyes (£12m).

So where does Greater Manchester and the North West fit into this venture capital landscape? Perhaps someone with access to Pitchbook or Beauhurst could run these figures for me. I’m waiting for you…

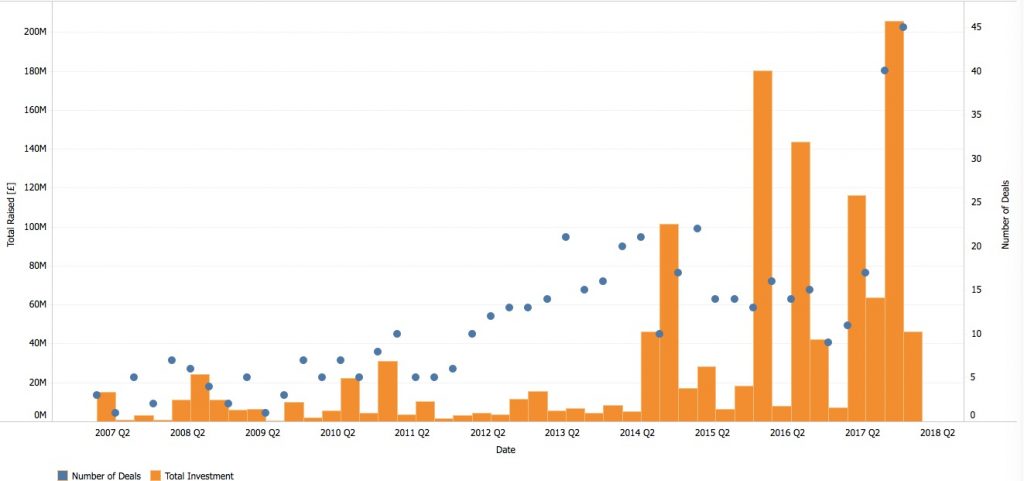

Whilst I wait, I’m happy to share the following from TechNation which captures whole of the North rather than just our region.

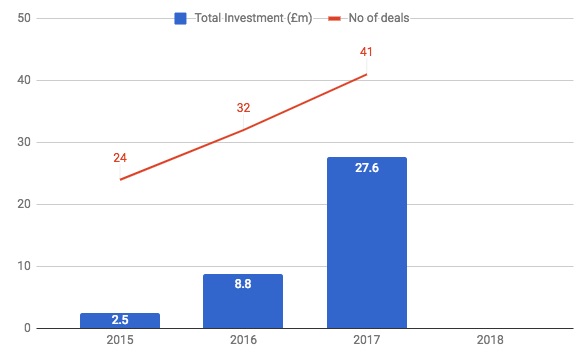

From the recent presentation in Manchester by Mike Dimelow, the following shows the investment landscape in Manchester and the North West (data comes from Beauhurst):

I’ll update this post as I find more information. Do share if you have access to further data please.

I’ll update this post as I find more information. Do share if you have access to further data please.

In the meantime, here is some data Techcelerate has captured (most have come from UKTN):

| Date announced | Company | Round Size ($m) | Round Size (£m) | Round | Key investors | Industry |

| 15/06/2018 | Pimberly | 3 | Series A | Mercia Fund Managers | Software | |

| 30/05/2018 | Airtime Rewards | 1.33 | 1 | Seed | Maven/NPIF | RetailTech |

| 24/04/2018 | Immotion | 0.70 | 0.5 | Seed | Sure Ventures | VR/AR |

| 11/04/2018 | Eoovi | Seed | ick O’Neill, Gary Monaghan and Peter Borner. | Video | ||

| 11/04/2018 | vTime | 7.6 | 5.71 | Series A | Deepbridge Capital, MSIF | VR/AR |

| 23/03/2018 | Coeus Software | 0.80 | 0.6 | Seed | Maven/NPIF | Software |

| 22/03/2018 | Matillion | 20 | 14.19 | Series B | Sapphire Ventures, Venture Partners | Data |

| 16/03/2018 | AccessPay | 1.39 | 1 | Series B | Maven/NPIF | FinTech |

| 13/03/2018 | Zilico | 19.03 | 13.5 | Corporate | MaxHelath Medical Group, Deepbridge Capital | HealthTech |

| 13/03/2018 | CurrentBody | 6.96 | 5 | Private Equity | NVM Private Equity | RetailTech |

| 12/03/2018 |

Cloud Technology Solutions

|

Private Equity | NorthEdge | IT Services | ||

| 09/03/2018 | GradTouch | 0.35 | 0.25 | Seed | Maven/NPIF | Recruitment |

| 02/03/2018 | TickX | 4.16 | 3 | Series A | BGF Ventures, Ministry of SOund, 24Haymarket | Search Engine |

| 12/03/2018 | Avanite | 0.69 | 0.5 | Seed | Dow Schofield Watts Angels | Software |

| 19/02/2018 | Out There | Seed | MSIF and Andrew Windsor | SaaS | ||

| 14/02/2018 | PowerLinks | 6.3 | 4.58 | Series A | Foresight Group | AdTech |

| 04/01/2018 | Upside Energy | 7.4 | 5.5 | Series A | Legal & General Capital, SYSTEMIQ | Energy |

| 29/11/2017 | MindTrace | 1.7 | 1.3 | Seed | Accelerated Digital Ventures (ADV), Northern Powerhouse Investment Fund | AI |

| 14/09/2017 | OfferMoments | 1.9 | 1.5 | Venture | Michael Edelson (Manchester United FC), Paul Althasen (MPC), Apadmi Ventures | AdTech |

| 11/09/2017 | Peak | 3.2 | 2.5 | Series A | MMC Ventures | DaaS |

| 04/09/2017 | Cubic Motion | 25.9 | 20 | Private Equity | NorthEdge | SaaS, Gaming |

| 05/07/2017 | Push Doctor | 26.1 | 20.2 | Series B | Accelerated Digital Ventures, Draper Esprit, Oxford Capital, Partech Ventures, Senveture Partners | HealthTech |

| 19/06/2017 | Now Healthcare Group | 5 | 4 | Series A | Medicash | HealthTech |

| 03/05/2017 | VST Enterprises | 14.7 | 11.4 | Venture | Chris Lightbody, Guy Weaver (director at KPMG) | Cybersecurity |

| 07/02/2017 | DigitalBridge | 0.87 | 0.7 | Seed | Stuart Marks, John Lewis | RetailTech |

| 24/02/2017 | SurveyMe | 2.4 | 2 | Equity | Deepbridge Capital’s Technology Growth EIS proposition | Software/App dev |

| 19/09/16 | DueCourse | 1.59 | 1.25 | Seed | Global Founders Capital, Simon Franks, Alex Chesterman | FinTech |

| 18/07/2016 | MarketInvoice | 9.3 | 7.2 | Series B | MCI.TechVentures Fund | FinTech |

| 07/01/2016 | PushDoctor | 8.2 | 5.6 | Series A | Oxford Capital Partners, Draper Esprit, Partech Ventures | HealthTech |

Summary figures from above, which indicate significantly higher level of investment than the stats Mike Dimelow of ADV shared (shown above):

| Total Funding (£m) | YoY Growth | |

| 2016 | 14.05 | |

| 2017 | 63.6 | 452.67% |

| 2018 | 58.33 | 91.72% |

| 135.98 |

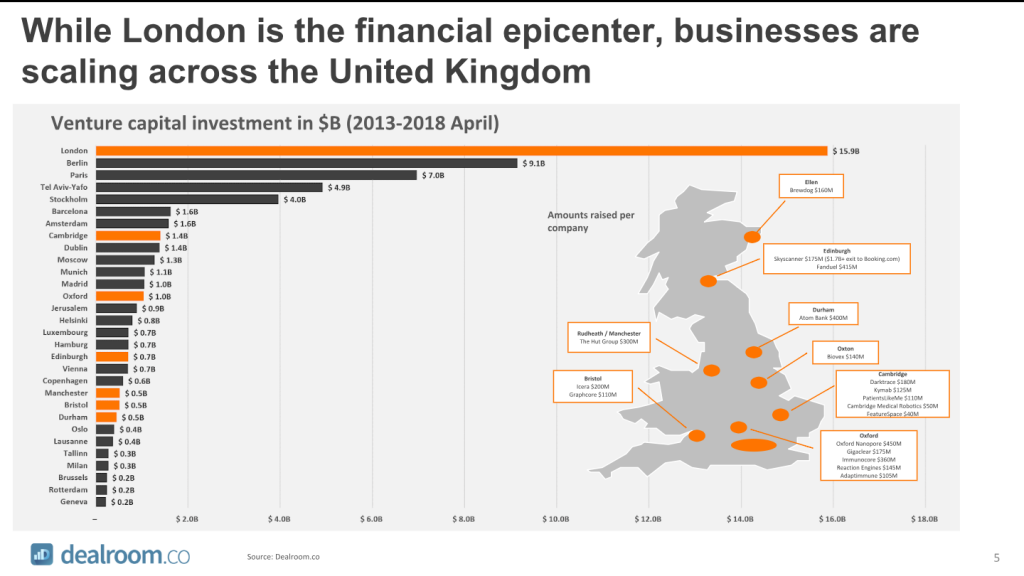

According to TechNation and Dealroom, Manchester has not done that well in terms of UK rankings if you consider a wider period from 2013 to 2018. Manchester has attracted $500m of investment, but second to London, Cambridge, Oxford and Edingburgh. Manchester is just ahead of Bristol and Durham. Whilst further scrutiny is required, $300 of the $500m was raised by The Hut Group. In May 2018, The Hut Group secured a credit line of £600m.

References:

- TechNation: UK tech extends lead over Europe